ETF Investment Strategies Explained: A Complete Guide

Discover the ins and outs of ETF investment strategies with HDFC SKY’s all-encompassing guide. This comprehensive platform by HDFC Securities provides a seamless investing experience, boasting zero account opening fees and lifetime zero brokerage on ETFs. Dive into a world of financial instruments with a user-friendly app catering to all levels of investors.

Introduction to ETFs

HDFC SKY’s introduction to ETFs provides investors with a straightforward and efficient way to diversify their portfolios. ETFs, or exchange-traded funds, are investment funds that are traded on stock exchanges similar to individual stocks. With HDFC SKY, investors can access ETFs without incurring any brokerage fees for a lifetime, making it a cost-effective option for those looking to invest in a diversified basket of securities. ETFs offer investors exposure to various asset classes such as stocks, bonds, commodities, and currencies, allowing for a well-rounded investment strategy that aligns with individual risk tolerance and financial goals.

ETF Recommendations by HDFC SKY guide investors in selecting the best options tailored to their needs. With expert insights, investors can make informed decisions to enhance their portfolios, maximizing returns while minimizing risks, and ensuring their investment strategy remains aligned with their financial objectives.

Moreover, HDFC SKY’s user-friendly app simplifies the process of investing in ETFs, making it accessible to both beginners and seasoned investors. The platform offers a wide range of ETF options, giving investors the flexibility to choose funds that match their investment objectives. In addition to zero brokerage fees, HDFC SKY provides educational resources and tools to help investors make informed decisions about their ETF investments. By offering a seamless and cost-effective way to invest in ETFs, HDFC SKY empowers investors to build diversified portfolios and achieve their financial objectives with confidence.

Benefits of ETF Investments

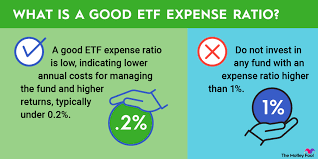

Investing in Exchange-Traded Funds (ETFs) through HDFC SKY offers a plethora of benefits for investors. Firstly, ETFs are known for their cost-effectiveness as they typically have lower expense ratios compared to actively managed mutual funds. With HDFC SKY’s zero brokerage on ETFs for a lifetime, investors can further maximize their returns by saving on transaction costs. Additionally, ETFs provide diversification by investing in a basket of securities, reducing the risk associated with individual stock-picking. This diversification is crucial for building a resilient investment portfolio that can weather market fluctuations and economic uncertainties.

Furthermore, HDFC SKY’s platform provides investors with easy access to a wide range of financial instruments, including stocks, mutual funds, IPOs, F&O, currencies, and commodities. This diverse offering allows investors to create a well-balanced and diversified investment portfolio tailored to their financial goals and risk appetite. The user-friendly app interface ensures that both novice and experienced investors can navigate the platform seamlessly, enabling them to make informed investment decisions. By leveraging the benefits of ETF investments through HDFC SKY, investors can enhance their portfolio performance, optimize costs, and build a robust investment strategy for long-term wealth creation.

Exchange Traded Fund offerings on HDFC SKY provide investors with a cost-effective way to diversify their portfolios. With real-time tracking and transparency, ETFs empower investors to capitalize on market opportunities, ensuring strategic asset allocation and enhanced financial growth potential for achieving long-term financial aspirations.

Types of ETFs

HDFC SKY provides investors with access to various types of Exchange-Traded Funds (ETFs) through its platform. ETFs are investment funds that are traded on stock exchanges, similar to individual stocks. One type of ETF available on HDFC SKY is equity ETFs, which invest in a diversified portfolio of stocks representing a particular index, sector, or market. These ETFs offer investors the opportunity to gain exposure to a specific segment of the stock market without having to buy individual stocks. Another type of ETF offered on HDFC SKY is bond ETFs, which invest in a portfolio of bonds, providing investors with exposure to the fixed-income market. Bond ETFs offer diversification, liquidity, and transparency, making them an attractive option for investors looking to add fixed-income securities to their portfolio.

Additionally, HDFC SKY offers investors access to commodity ETFs, which invest in physical commodities such as gold, silver, oil, or agricultural products. Commodity ETFs provide investors with a way to gain exposure to the commodity markets without the need to directly invest in physical commodities or futures contracts. Another type of ETF available on HDFC SKY is thematic ETFs, which invest in companies that are aligned with a particular theme or trend, such as clean energy, technology, or healthcare. Thematic ETFs allow investors to capitalize on specific market trends or sectors that they believe will outperform the broader market. With a wide range of ETF options available on HDFC SKY, investors can build a diversified portfolio tailored to their investment goals and risk tolerance.

Passive vs. Active ETF Strategies

Passive vs. Active ETF Strategies are key considerations for investors using the HDFC SKY platform. Passive ETFs track a specific index, aiming to replicate its performance, such as the Nifty 50 or S&P 500. These ETFs offer lower management fees compared to active ETFs, making them an attractive option for cost-conscious investors. Passive strategies are popular for their simplicity and transparency, as they require minimal oversight and typically have lower turnover. On the other hand, active ETFs rely on fund managers’ expertise to outperform the market. These ETFs involve higher management fees due to the active management involved in selecting and adjusting the portfolio. While active strategies offer the potential for higher returns, they also come with increased risk and the possibility of underperforming the market.

how to invest in etfs on the HDFC SKY platform involves understanding the distinct benefits of passive and active strategies. Investors must weigh cost, risk, and potential returns to select the approach that aligns with their financial goals and risk tolerance.

Investors using the HDFC SKY platform can benefit from a mix of passive and active ETF strategies to diversify their portfolios. Passive ETFs can provide broad market exposure at a lower cost, ideal for long-term investors seeking steady returns. Active ETF strategies, on the other hand, offer the opportunity to capitalize on market inefficiencies and potentially outperform the benchmarks. By combining both approaches, investors can achieve a balanced investment portfolio that aligns with their risk tolerance and financial goals. With zero brokerage fees on ETFs, HDFC SKY enables investors to explore and implement various strategies seamlessly, empowering them to build a diversified and efficient investment portfolio tailored to their preferences and objectives.

Sector and Industry ETFs

Sector and Industry ETFs are exchange-traded funds that focus on specific sectors or industries within the market. These ETFs provide investors with a way to gain exposure to a particular sector, such as technology, healthcare, energy, or consumer goods, without having to pick individual stocks. By investing in Sector and Industry ETFs, investors can diversify their portfolios and reduce risk by spreading their investments across multiple companies within the same sector. HDFC SKY, offered by HDFC Securities, provides investors with a platform to access a wide range of Sector and Industry ETFs, allowing them to tailor their investments based on their market outlook and investment goals.

HDFC SKY’s zero account opening fees and lifetime zero brokerage on ETFs make it a cost-effective option for investors looking to build a diversified portfolio with Sector and Industry ETFs. With the platform’s user-friendly app, both novice and experienced investors can easily research, analyze, and invest in a variety of ETFs, including those focused on specific sectors and industries. Whether investors are bullish on a particular sector or looking to hedge their portfolio against market volatility, Sector and Industry ETFs available on HDFC SKY offer a convenient and efficient way to gain exposure to different segments of the market.

Demat Account App from HDFC SKY also provides real-time market data, empowering investors with insights and updates to make informed decisions. The app’s seamless navigation and robust features cater to both short-term traders and long-term investors seeking to maximize their investment potential.

Leveraged and Inverse ETFs

Leveraged and Inverse ETFs are specialized exchange-traded funds that aim to provide amplified returns or inverse returns relative to the underlying index they track. Leveraged ETFs use financial derivatives and debt to magnify the returns of the index they follow. For example, a 2x leveraged ETF seeks to double the daily return of its benchmark index. On the other hand, inverse ETFs are designed to deliver the opposite performance of the index they track. These ETFs are typically used by sophisticated investors seeking short-term trading opportunities, hedging strategies, or to capitalize on market volatility. It is important to note that leveraged and inverse ETFs carry a higher level of risk compared to traditional ETFs due to their complex structure and daily reset feature, which can lead to significant losses if held for an extended period.

HDFC SKY, offered by HDFC Securities, is a cutting-edge investment platform that provides investors with access to leveraged and inverse ETFs along with a wide range of other financial instruments. With no account opening fees and lifetime zero brokerage on ETFs, HDFC SKY caters to both beginners and seasoned investors looking to diversify their portfolios and explore alternative investment strategies. The platform’s user-friendly interface makes it easy for users to navigate and trade various financial products, including stocks, mutual funds, IPOs, F&O, currencies, and commodities. By offering leveraged and inverse ETFs within its comprehensive suite of investment options, HDFC SKY empowers investors to take advantage of market trends and potentially enhance their investment returns while managing risk effectively.

ETFs for Income Generation

HDFC SKY’s emphasis on ETFs for income generation caters to investors seeking stable and predictable returns. Exchange-Traded Funds (ETFs) are a popular choice for income generation due to their diversified nature and passive management style. HDFC SKY offers a range of ETF options that provide investors with exposure to various asset classes, such as equities, bonds, and commodities, allowing them to create a well-rounded income-generating portfolio. With lifetime zero brokerage on ETFs, investors can capitalize on the income potential of these funds without incurring additional costs, making it an attractive option for those looking to maximize their returns.

Moreover, HDFC SKY’s user-friendly platform makes it easy for investors to research, select, and invest in ETFs that align with their income generation goals. The platform’s seamless interface and comprehensive educational resources empower investors to make informed decisions and build a diversified income-generating portfolio tailored to their risk tolerance and investment objectives. By providing access to a wide range of financial instruments beyond ETFs, including stocks, mutual funds, and derivatives, HDFC SKY equips investors with the tools they need to create a robust income generation strategy that suits their unique financial needs and preferences.

Tax Considerations for ETF Investors

When considering tax implications for ETF investors, it is essential to understand the unique advantages and challenges of investing in Exchange-Traded Funds. HDFC SKY, a groundbreaking investment platform by HDFC Securities, offers investors a zero brokerage lifetime on ETFs, making it an attractive option for those looking to minimize transaction costs. ETF investors benefit from tax efficiency due to the structure of these funds, which typically result in lower capital gains distributions compared to mutual funds. This can lead to reduced tax liabilities for investors, especially those in higher tax brackets.

Furthermore, ETF investors should be aware of the tax consequences related to buying and selling ETFs. Capital gains taxes are incurred when selling ETF shares at a profit, and the holding period can impact the tax rate applied. With HDFC SKY’s user-friendly app, investors can easily track their ETF transactions and monitor their tax obligations. Additionally, investors should consider tax-loss harvesting strategies to offset capital gains and reduce their overall tax burden. By leveraging the tax advantages offered by ETFs and utilizing tools like HDFC SKY, investors can optimize their tax situation and enhance their overall investment returns.

ETF Trading Tips and Best Practices

When it comes to trading ETFs on HDFC SKY, there are several tips and best practices that investors can follow to maximize their returns and minimize risks. Firstly, it is crucial to conduct thorough research on the ETFs available on the platform. Investors should analyze the underlying assets, past performance, expense ratios, and market trends to make informed decisions. Diversification is key in ETF trading, as it helps spread out risks across different sectors or asset classes. By investing in a mix of ETFs, investors can balance their portfolios and potentially reduce the impact of market volatility.

Furthermore, setting clear investment goals and sticking to a disciplined investment strategy is essential. Investors should determine their risk tolerance, investment horizon, and financial objectives before trading ETFs on HDFC SKY. Regularly monitoring the performance of ETFs and staying updated on market news and events can help investors make timely adjustments to their portfolios. It is also advisable to take advantage of the research tools and educational resources provided by HDFC SKY to enhance one’s understanding of ETF trading and investment strategies. By following these tips and best practices, investors can navigate the world of ETF trading with confidence and achieve their financial goals.

Building a Diversified ETF Portfolio

Building a diversified ETF portfolio through HDFC SKY offers investors a convenient and cost-effective way to spread their investments across a wide range of asset classes. ETFs (exchange-traded funds) are a popular investment vehicle that provides exposure to a basket of securities, such as stocks, bonds, or commodities, in a single trade. With HDFC SKY’s zero account opening fees and lifetime zero brokerage on ETFs, investors can build a diversified portfolio without incurring high transaction costs, making it an attractive option for both new and seasoned investors. The platform’s user-friendly app simplifies the process of researching, selecting, and monitoring ETFs, allowing investors to easily create a well-balanced portfolio tailored to their risk tolerance and investment goals.

By leveraging HDFC SKY’s wide range of financial instruments, investors can create a diversified ETF portfolio that can help reduce risk and improve long-term returns. Diversification is a key principle of investing that involves spreading investments across different asset classes to mitigate the impact of market volatility and specific risks associated with individual securities. With access to not only ETFs but also stocks, mutual funds, IPOs, F&O, currencies, and commodities, investors can construct a well-rounded portfolio that aligns with their investment strategy. Whether investors are looking to build a conservative portfolio focused on income generation or a growth-oriented portfolio with higher risk tolerance, HDFC SKY provides the tools and resources to help investors achieve their financial goals through a diversified ETF portfolio.